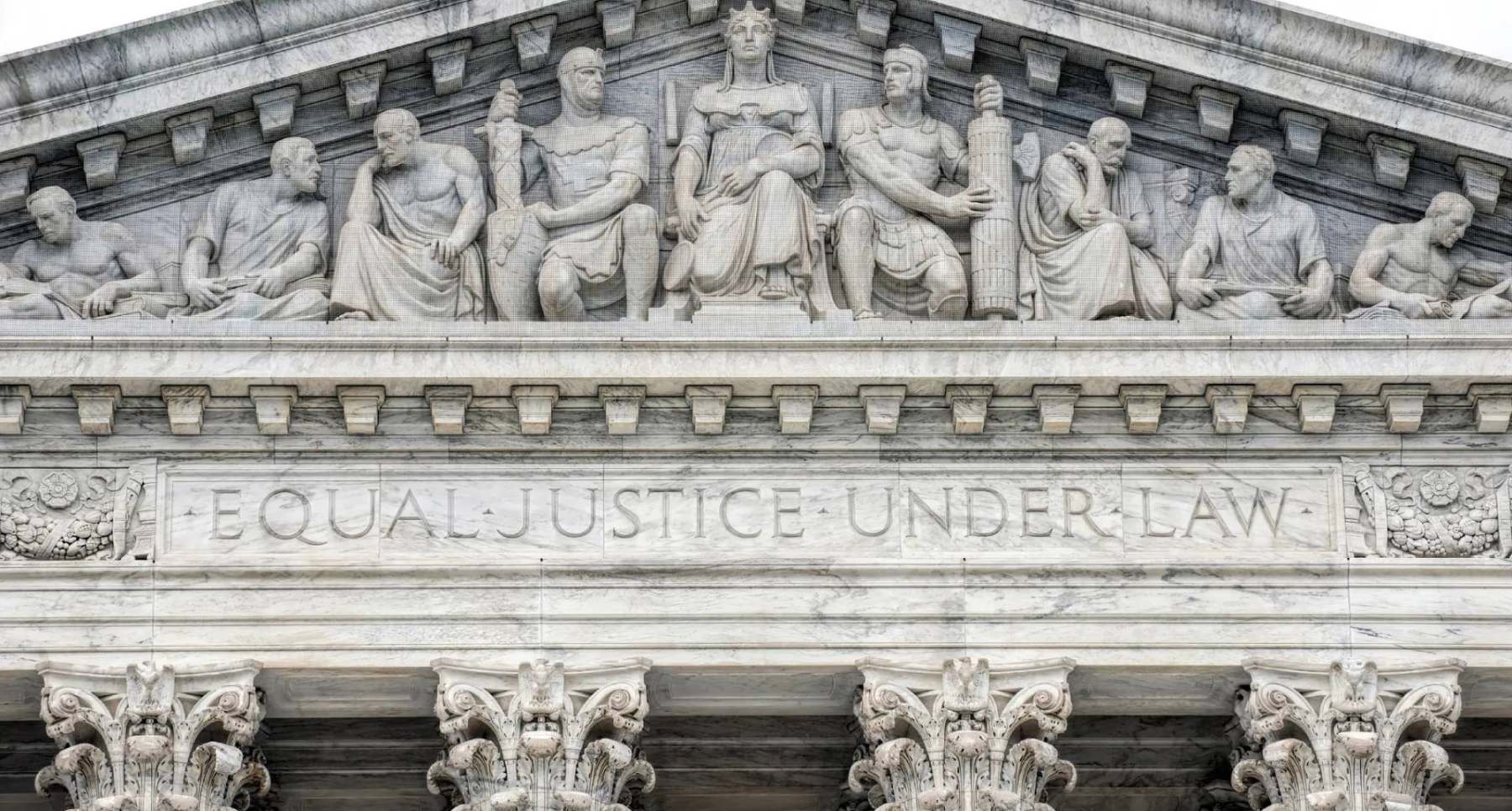

Urba Law PLLC, New York Employment Law

New York Employment Law Firm

New York employment law litigation and mediation is Urba Law PLLC’s singular focus. We provide quality representation, in a timely manner, at a fair price. More than 25 years of legal experience have shown Jonas Urba how important it is to collaborate with clients, assess each client’s unique needs, and look for an equitable resolution. Client reviews speak volumes. They confirm the firm’s ongoing commitment, persistence, creativity, and availability, placing each client’s interest above the firm’s interest.

Urba Law PLLC handles many types of employment law matters across the entire State of New York which include:

- Sexual harassment

- LGBT workplace rights

- Workplace discrimination (i.e. sex, race, disability)

- Mediation – Employment Law, Employment Discrimination, Wage & Hour

- Employer retaliation and wrongful termination

- Wage and hour litigation, unpaid overtime

- Regarded as disabled discrimination and failure to accommodate

- Hostile workplaces

- Employment Contracts

- Employment Litigation

- Severance Agreements

- Employer legal matters/representation

- Defend Trade Secrets Act (DTSA) disputes

- Non-competition Agreement Litigation

Contact us today for a free initial consultation or to schedule a virtual or in-person appointment at (212) 731-4776.

Lefcourt Colonial Building, 295 Madison Ave 12th Floor, #1200V, New York, NY 10017.

https://urbaemploymentlaw.com/about/

https://urbaemploymentlaw.com/new-york-employment-law-videos-blog/

https://urbaemploymentlaw.com/contact/

Following are some legal resources explaining why protected classes mean so much.

https://www.eeoc.gov/harassment

https://dhr.ny.gov/new-workplace-discrimination-and-harassment-protections

https://www.nyc.gov/site/cchr/law/the-law.page

https://www.jamsadr.com/newyork